Midcap, Smallcap & Microcap Stocks

Selected based on Value Investing principles

4 Past Reports + 1 Report every month = Total 28 Reports

Past Returns 5 Years holding period

Access to Multiverse Tools, Free ebooks Rs. 2000

GST 18% included in Price

Rs. 50000 Value Service – Compared to other advisors

2 Year Multicap Plan + Master Mind Training

Master Mind is 3 Month recorded videos f

1 Video every week + 1 LIVE Class every month

Quick Exams to evaluate your progress

Training essential to Level-Up as Pro-Investor

LIVE Classes on Net Worth Building & Scam Protections

Have the Foundations for Creating Multi-Crore Wealth

It is Investor Foundation Mindset – Read more here

New Multicap Released: Feb 28 2026 – AI/ML Multibagger

What’s inside?

You will get 2 Mulitbagger Reports immediately on subscription

1. High Growth eco recycling company with zero debt

2. Super Finance Company multibagger with CAGR 50% growth

High Conviction. Advisor Team Invested.

Years

Subscribers

Multibaggers

Crores Created

More Services

LIVE Coaching Plan

- 1 Month Duration

- 8 Classes – 2 every week (Wed & Sat 8PM)

- Fundamentals of Stock Market

- Portfolio Management, Bear Market Handling

- Personal Finance, Net Worth Calculation

- Financial Freedom Guidance

SME Plan

10 SME Stocks in this plan over 2 Year Subscription period

1-2 Lakh investment per stock

Advisor Team invested

Click button to get more information

Welcome to the Land of Multibaggers!

Futurecaps created 50+ Multibaggers in the past 10 years. We use Value Investing principles of Warren Buffett in identifying multibagger & hold for long-term.

Why we kept our prices low?

As you can see around, Everybody is Increasing their Prices so only the Riches can afford it! That will make New Investors afford a quality service. Hence we keep our prices low!

Inspired from RATAN TATA!

Warren Buffett Principles

Futurecaps is built on the principles of Warren Buffett – International Giant of Value Investing!

– Economic Moat

– Value Investing

– Long Term Holding

– Bear Market Handling

– No Trading

It is been a honor to live in the the times of Great Warren Buffett!

– Paul, Futurecaps (MBA, PhD, SEBI Research Analyst)

Value Investing

Value Investing is the Best Form of Investing.

Buy Stock if Value > Market Price

Value Investing can be applied to Stock Market, Real Estate & Career

Long Term Holding

No magical wealth creation possible in short time.

Company requires time to expand, increase sales & reflect in stock price increase.

Compounded Returns of 100X, 1000X only possible in long-term investing.

Bear Market Handling

Bear Markets are Opportunities for Long-term Investor

Celebrity Investors are happy about Bear Markets. They view it as Discount Mela.

500% returns will be zoomed to 1000% if invested in bear market.

No Trading

Trading is not the purpose of stock market.

No Trader been Top Rich in the world!

Celebrity Investors are created Wealth through Investing!

Start with a Portfolio Review

If you wanted to Start with a Portfolio Review of yours, You can Book a Call with our Research Analyst.

You will get your queries answered + your portfolio reviewed upto 25 stocks.

[remember converting those lossy stocks to growth ones makes lakhs & crores difference in the long run]

Why Stock Market?

Watch this 2 minute quick video to Learn why you should choose stock market?

Frequently Asked Questions

Here are frequently asked questions about our subscription services.

What is the Minimum Capital required?

You can start with Rs. 5000 onwards.

What is the Price Range of the multibagger?

Price range varies from Rs. 100 to 1000.

How will I receive the Multibagger report?

You will receive through email. Also, you can register for whataspp notifications.

What is the Holding Period?

The minimum holding period is 5 years. Long-term holding required so company perform, expand & appreciate wealth.

Will I get past multibagger reports?

Yes, you will get past 2-6 reports immediately on subscription.

Do you give Tracking & Updates?

Yes, tracking & updates will be sent to email even after the subscription period.

What is your Refund Policy?

You can request refund within 1 week of subscription. See refund policy.

How can I contact Support?

You can email to contact@futurecaps.com Or use whatsapp message.

VALUES OF FUTURECAPS

Years back when I was new to stock market, I was fascinated by the Quick money making schemes of Trading, F&O etc. Later with losses I realized these are Fake schemes which only make the advisors rich. More on this

Then I learnt about Fundamentals of Stock Market & Warren Buffett where I realized Long-term investing is the True purpose of stock market & Investing is passive where your money works for you. I applied the principles of Researching & Buying stocks for 5+ years including bear market re-investments. This gave Multibagger Profits which enabled me to afford luxury, do more charity & achieve financial freedom.

I thought of converting the stock ideas to a business – so that I can help like-minded investors with an affordable service. Remember, paying high advisor fees does not give high returns – we have created super multibaggers at affordable fees – you can reinvest the saved fees to make crores difference in the long-term!

– There is Free Plan for New Investors with no money for subscription. This enables them to make money, trust our service & buy higher plans

– There is 1 Year Multicap Plan @ Affordable Price

– There is Advisor Plan for HNI Investors @ Discounted Price

– There is Financial Freedom Coaching @ Affordable Price

Our Top Performances can be verified by Proofs. Today Futurecaps have Top in World reports, tools & trainings for achieving Investor Success. But I am not greedy to charge high money from clients. I follow the Values of Ratan Tata to ensure Good Service @ Value Prices. Request: No piracy please!

Paul (SEBI Registered Research Analyst, Futurecaps)

Only the Reader reaches Treasure! READ MORE

Click on the Whatsapp Icon to Initiate Chat with Representative of Futurecaps.

Or, you can Email Us or Book Appointment to call you back

About

Futurecaps is SEBI Registered Research Analyst Paul with Registration Number INH200006956 & GST Number 32AMYPP9283E1ZD serving Indian Investors since 2012.

Futurecaps follow Value Investing principles of Warren Buffett and created 50+ multibaggers in the past. We keep the prices low so that not just the rich, but middle class can also afford it.

Contact

Email: contact@futurecaps.com

Phone: +91 62826 29567

Address: #202, 895 A1, HSR Sector 3, Bangalore 560102

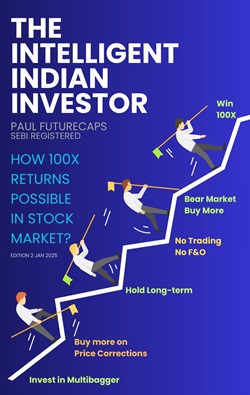

Futurecaps eBook

If you are thinking of where to start in stock market – trading, f&o, investing , then this book will help you with the right path & save your time, money & confidence.

Remember, if you went with a wrong path for 5 years, then your loss is 500%. Eg: If you have 5 Lakh capital then it is 25 Lakh loss!

Buy Kindle eBook here

Futurecaps App

Get Futurecaps App for Android. Get Stock Market contents at the comfort of your Smartphone

Sridhar

Sridhar